Post-pandemic, co-operatives can scale up to promote the values of mutuality, inclusivity, economic justice and organizational democracy towards a transitioned Canadian economy. (Pixabay)

Post-pandemic, co-operatives can scale up to promote the values of mutuality, inclusivity, economic justice and organizational democracy towards a transitioned Canadian economy. (Pixabay)

As the epidemiological impacts of COVID-19 grow exponentially, so do business closures, unemployment rates, poverty, housing and food insecurities.

It’s not surprising to researchers of co-operatives and community economic development that the outbreak of COVID-19 spurred Canada’s co-operative sector to immediately step up and respond to the needs of communities — in many cases, sooner and more concretely than the federal, provincial and local governments as well as large corporations.

For example, grocery co-ops innovated employee safety and salary top-up while worker co-ops quickly shifted to producing medical products, and credit unions offered far-reaching grants to community groups, loan deferrals and even zero-interest credit cards.

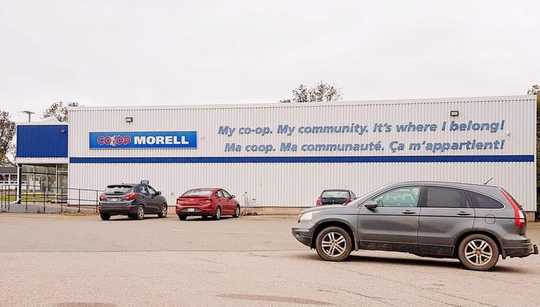

Co-op Morell is a grocery co-op in Prince Edward Island. Author provided

Co-op Morell is a grocery co-op in Prince Edward Island. Author provided

The co-op sector can also be an integral part of the socio-economic rebuilding to come.

There are more than 31.8 million memberships in co-operative enterprises in Canada that are present in most communities. Well-known Canadian co-ops include MEC, Agropur Coopérative and The Co-operators.

While co-operatives have a significant history in this country, their relevance during the current COVID-19 crisis has been especially consequential for members, communities and businesses.

Post-pandemic, will co-operatives and community economic organizations become leaders in rebuilding Canada’s economy to be more equitable and humane? Can the COVID-19 crisis be a call to a much-needed economic transition?

Co-operatives for communities, by communities

Canada’s co-operatives are a part of a global movement of more than three million co-ops and a billion members. Co-operatives are businesses co-owned by interested members rather than disconnected shareholders, rooting capital in local communities. Rather than prioritizing profit above all, co-operatives tend to focus on member and community needs first.

They are guided by values and principles of inclusivity, economic democracy, education and concern for community. They work towards fostering strong bonds of trust with stakeholders and provide more equitable places to shop and work. These features have been called “the co-operative advantage.”

Community care is at the heart of most of the millions of co-operatives the world over, including Canada’s.

Today, co-operatives are present across most of Canada’s economic sectors, making up 3.4 per cent of its GDP and generating almost $86 billion in business activity.

Co-ops’ quick responses during COVID-19

By their very nature, co-operatives are already one step ahead of many other organizations for responding to crises because of the connected and action-oriented role they play in communities.

Co-operatives are stable employers, communication conduits of communities’ needs, places where community members meet and create and venues for participatory democracy. This is why co-operatives have been able to rise quickly to the challenges COVID-19 has thrown at communities.

Canada’s consumer co-operatives — co-owned by people who buy and use their goods and services — were among the first businesses to secure employees’ incomes, set aside shopping time for vulnerable groups and contribute free goods and services to marginalized and at-risk people.

For instance, as early as mid-March, Coopérative Alina in Rimouski, Qué., established bicycle-delivered lunch menus and nightly car-delivered services, whereas larger Canadian stores were still scaling up delivery in late March.

Also by mid-March, Calgary Co-op, one of the first grocery stores to offer differentiated hours for seniors shopping, raised front-line team members’ salaries by $2.50 an hour, retroactive to March 8. To compare, the federal government’s Canada Emergency Wage Subsidy was announced on April 1, and is retroactive to March 15.

Canada’s consumer co-ops are also leading inter-community co-operation. Québec’s Associations co-opératives d’économie familiale have been working with local groups to help people who find themselves without pay and cash due to the COVID-19 crisis. The Co-operative Housing Federation of Canada, meanwhile, by March 17 had co-ordinated, along with the co-op housing sector, rental relief and mortgage payment assistance with credit unions.

Helping vulnerable groups

Worker co-ops — businesses co-owned by employees — have been in step with international trends by supplying vulnerable groups and other local businesses or community associations with vital goods or services, often free of charge.

Montreal-based Co-op Couturières Pop is now primarily producing much-needed hospital garments and face masks. Worker-owned microbrewery Le Trou du Diable in Shawinigan, Qué., has topped up employee salaries by $5 an hour, continued to honour advertising purchases and even bought new ad space on local newspaper websites in order to help sustain the papers’ precarious revenue stream during the pandemic.

Canada’s credit unions — financial institutions co-owned by savers and service users — have also stepped up more significantly compared to the commercial banking sector, which has been more cautious responding to the everyday financial difficulties brought on by COVID-19.

Desjardins Group has offered credit relief to its members. THE CANADIAN PRESS/Ryan Remiorz

Desjardins Group has offered credit relief to its members. THE CANADIAN PRESS/Ryan Remiorz

By March 16, Desjardins Group, North America’s largest credit union federation, offered credit relief on a per-needed basis to members in addition to reduced credit card rates. Vancity Credit Union went even further, deferring payments and reducing credit card interest rates for people most affected by the pandemic to zero; as of April 9, no commercial bank in Canada had gone this far in offering credit relief.

By March 18, Vancity Credit Union had also partnered with charities to form the Community Response Fund; as of April 8, donations to the relief fund totalled $6 million and helped 33 non-profits and charities.

And by March 19, Northern Savings Credit Union was offering credit deferral, Ladysmith Credit Union offered interest-free loans by late March, and by April 3 Libro Credit Union contributed $320,000 to United Way emergency response programs.

Co-operatives can respond quickly because they already know what their members and communities need and want. They already have in place the necessary values, systems and operations to meet those member and community needs.

Imagining a more co-operative economy

It’s possible for existing co-operatives and support organizations, and their community-based responses to the crisis, to scale up. They have during other periods of crisis in Canada. Post-pandemic, they can promote the values of mutuality, inclusivity, economic justice and organizational democracy towards a new Canadian economy.

But that means co-operatives must continue to be included in supportive funding packages during the pandemic. To scale up further also requires new business and economic development legislation and policies to facilitate co-operative start-ups, or the conversion of troubled businesses and those with succession challenges into new co-ops.

The worker co-operative and community economic development sectors have already delivered proposals to the federal government to make this happen.

Co-operatives can and should be key to Canada’s economic rebuilding and rethinking — now and following the COVID-19 pandemic. Canadians, in fact, are very open to co-operative business models and values.

After addressing the immediate challenges of COVID-19 co-operatively, the time for a new and more co-operative economy for Canada is ready for seizing.![]()

About The Author

Marcelo Vieta, Assistant Professor, Adult Education and Community Development, Ontario Institute for Studies in Education, University of Toronto and Fiona Duguid, Adjunct Professor of Community Economic Development in the MBA Program, Cape Breton University

This article is republished from The Conversation under a Creative Commons license. Read the original article.

books_economy